Nilinaw ngayon ng Bureau of Internal Revenue (BIR) na exempted sa creditable withholding tax ang mga small-scale o maliliit na online sellers sa bansa.

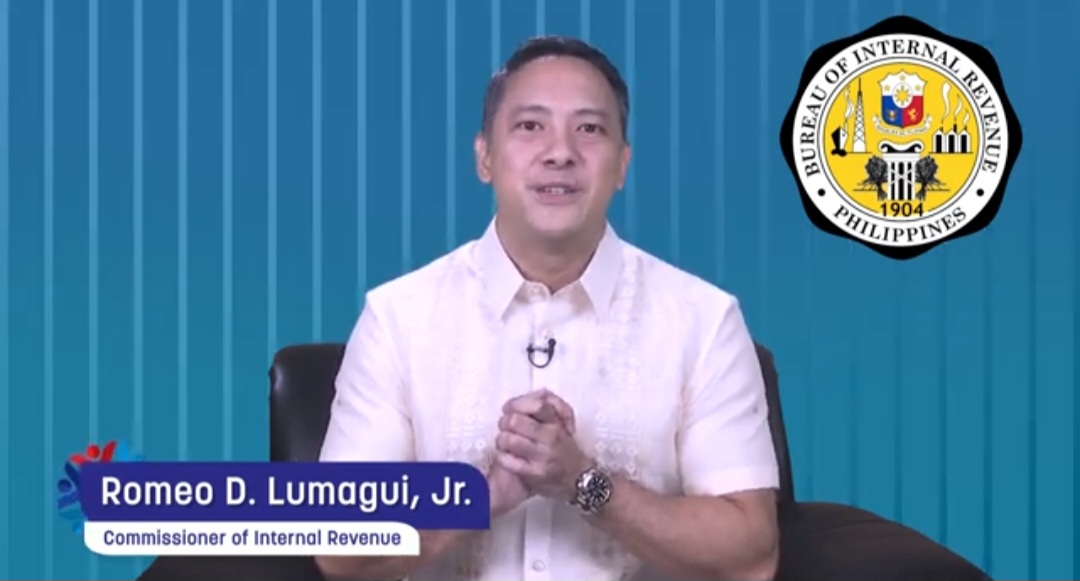

Sa isang pahayag, sinabi ni BIR Commissioner Romeo Lumagui Jr. na nakapaloob ito sa Revenue Regulation No. 16-2023 at Revenue Memorandum Circular No. 8-2024.

Ito aniya ay bilang tulong na rin sa maliliit na negosyante online.

“Small-scale online sellers are exempted from withholding tax. The BIR is sympathetic to small businesses in its approach to taxing online sellers/merchants,” pahayag ni Commissioner Lumagui.

Ang mga pasok sa tax exemption ay ang mga online seller na ang annual total gross remittances ay hindi lalagpas sa ₱500,000 sa nakalipas na taxable year.

Samantala, obligado na sa withholding tax ang isang online seller kung umaabot na sa higit kalahating milyon ang kanyang annual gross remittance.

“For those who are above the threshold of ₱500,000 annual gross remittance, it is only fair that they will be subjected to withholding tax. We have to be fair to the retail sector and brick and mortar stores who are regularly paying their taxes. If you have a business, you have to register and pay your taxes. It doesn’t matter if it’s an actual store or an online store. It is your responsibility to pay taxes like everyone else,” ani Lumagui.

Kaugnay nito, inatasan na ni Commissioner Lumagui ang mga tauhan ng ahensya na palaganapin ang information dissemination upang makabayad ang mga online sellers at online platforms sa kanilang tax obligation.

“The BIR has a friendly and approachable stance as regards the taxation of online sellers. We know that most of our online sellers do not have the intention to evade taxes. They just need guidance in the registration and payment processes. The BIR is here to provide all the guidance and explanation needed to this new sector of society. We are here to educate. We are at your service,” paliwanag ni Commissioner Lumagui. | ulat ni Merry Ann Bastasa