Suportado ng Philippine Tobacco Institute (PTI) ang itinutulak na panukala sa Kamara na patawan ng mas mabigat na parusa ang illicit tobacco trade.

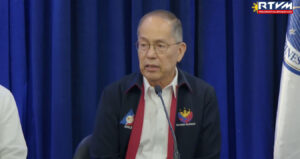

Ayon kay dating Representative Jericho Nograles, Pangulo ng PTI, kada taon ay tumataas ang iligal na bentahan ng tobacco products ng 3 percent hanggang 8 percent.

Katunayan, sa Mindanao aniya 51% ng cigarette supply ay iligal habang nasa 12.8 percent naman para sa North at Central Luzon.

Dahil dito, pinakokonsidera ng PTI sa Kongreso na repasuhin ang tax system para sa tobacco products, magpatupad ng single tax rate para sa lahat ng vapor products, at magkaroon ng whole-of-government approach sa pagtugis sa iligal na kalakaran ng tobacco products.

Mahalaga rin ayon kay Nograles na may makasuhan at mapakulong na iligal na importers, manufacturers at traders ang DOJ. | ulat ni Kathleen Forbes